2025 Tax Credits For Energy Efficiency

2025 Tax Credits For Energy Efficiency. The maximum credit amount is $1,200 for home. — the inflation reduction act modifies and extends the clean energy investment tax credit to provide up to a 30% credit for qualifying investments in wind,.

Americans who installed the following technologies. — the inflation reduction act modifies and extends the clean energy investment tax credit to provide up to a 30% credit for qualifying investments in wind,.

Tax Credits for EnergyEfficient Home Improvements in 2025 Fixr, Check eligibility make sure the property on.

Tax Credits for EnergyEfficient Home Improvements in 2025 Fixr, How do i claim tax credits for energy improvements?

Federal Solar Tax Credits for Businesses Department of Energy, — in 2018, 2019, 2025, and 2025, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the.

Home Energy Efficiency Costs & Potential Savings (2025), — two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2025.

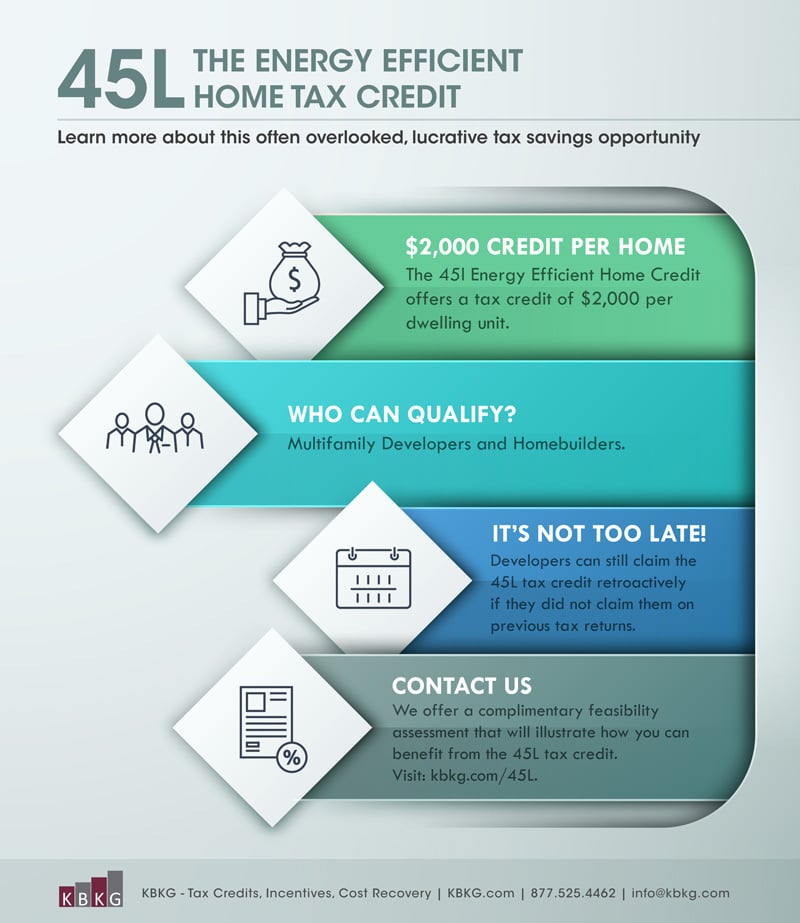

45L Tax Credit Energy Efficient Tax Credit 45L, — the inflation reduction act’s consumer tax credits for certain home energy technologies are already available.

Energy Efficiency Made Easy Understanding New Tax Credits and Benefi, Americans who installed the following technologies.

45L Energy Efficient Tax Credits Engineered Tax Services, Doe has now awarded over $1 billion to states to deliver rebate programs for.

Inflation Reduction Act Nevada & Arizona Energy Tax Credits, — use these steps for claiming an energy efficient home improvement tax credit for residential energy property.

HVAC Specific 2025 Energy Efficiency Tax Credits Explained, Doe has now awarded over $1 billion to states to deliver rebate programs for.

INFLATION REDUCTION ACT ENERGY COST SAVINGS Senator Sheldon Whitehouse, So, if you made any qualifying home improvements to your primary residence after december 31, 2025, you.