Hsa Max 2025 Employer Match

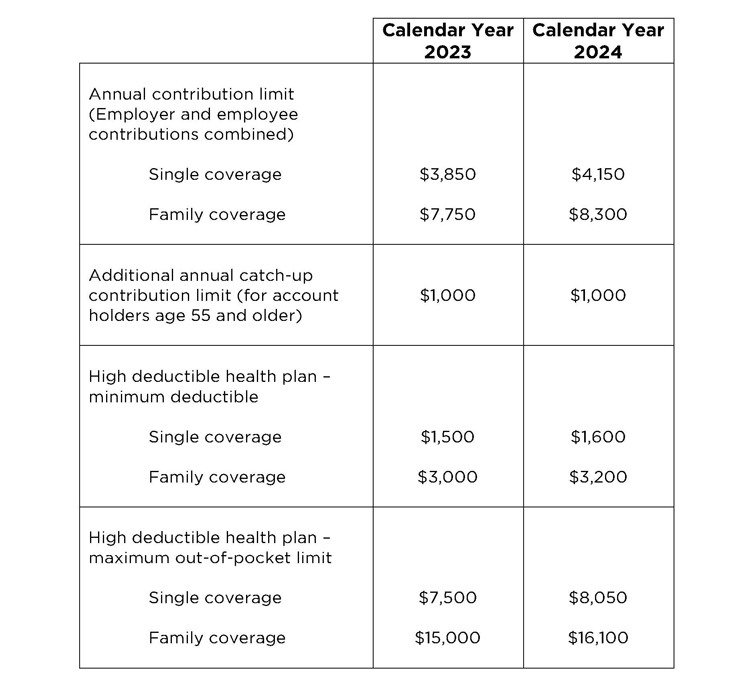

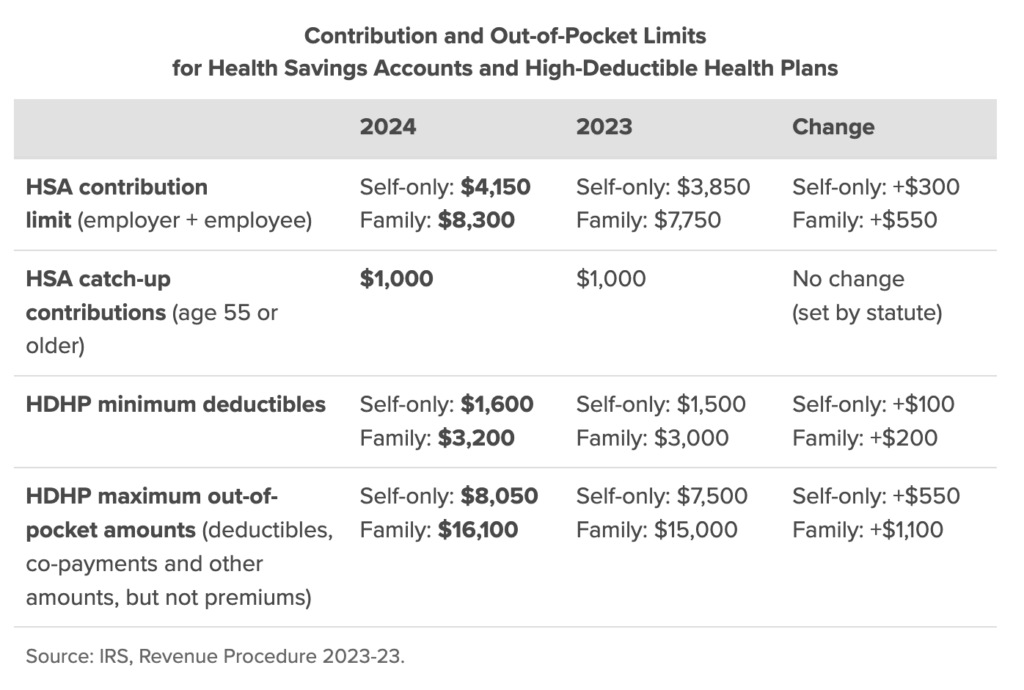

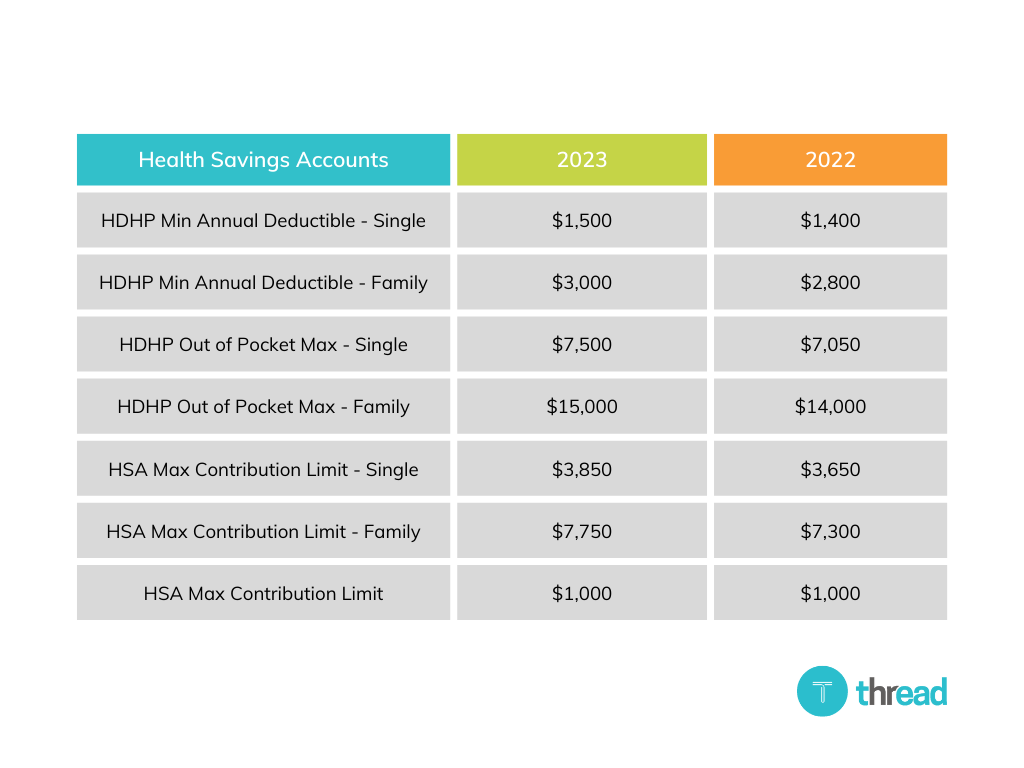

Hsa Max 2025 Employer Match. The maximum amount that may be made newly available for plan years beginning in 2025 for excepted benefit hras is $2,100 (up $150 from 2025). The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025.

The maximum hsa contribution amounts for 2025 are: Here’s what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually.

Hsa 2025 Max Prudi Carlotta, On may 9, 2025 the internal revenue service announced the hsa contribution limits for 2025. Individuals can contribute up to $4,150 and those with family coverage can contribute up.

Significant HSA Contribution Limit Increase for 2025, Individuals can contribute up to $4,150 and those with family coverage can contribute up. Employer contributions count toward the annual hsa.

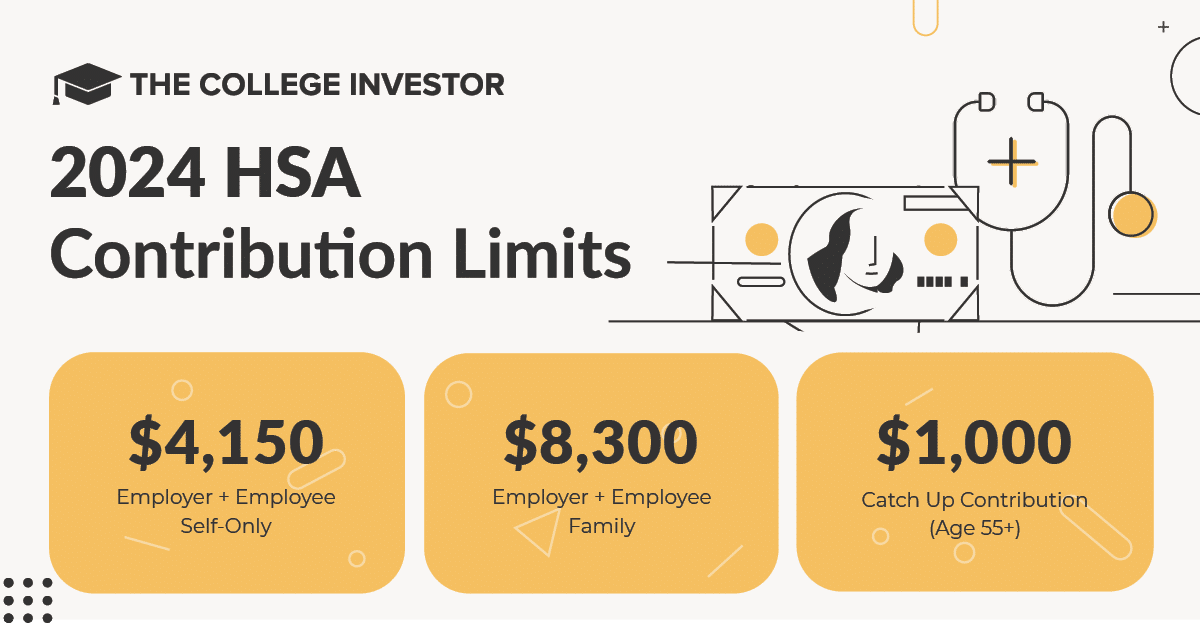

How Much Can I Put Into My Hsa In 2025 Joane Lyndsay, Hsa contribution limits for 2025 are $4,150 for singles and $8,300 for families. The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150.

How Much Can You Contribute To Hsa 2025 Colene Melosa, (people 55 and older can stash away an. An hsa has a maximum contribution of $3,400 from both the employee and the employer for single employees.

401k Threshold 2025 Tamma Fidelity, The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025. In may, the irs announced higher hsa contribution limits for plan year 2025.

Health Savings Account (HSA) Updates for 2025 UA Human Resources, Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families. For employees who have dependents on their.

Worksheets Calculating A Maximum HSA Contribution for Employers Lively, For employees who have dependents on their. The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150.

Unleashing the maximum hsa contribution 2025, An hsa has a maximum contribution of $3,400 from both the employee and the employer for single employees. The health savings account (hsa) contribution limits effective january 1, 2025, are among the largest hsa increases in recent years.

HSA Contribution Limits 2025 and 2025, The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025. The maximum hsa contribution amounts for 2025 are:

Unleashing the maximum hsa contribution 2025, Use this information as a. Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families.