Niit Income Threshold 2025

Niit Income Threshold 2025. The niit would apply to. The niit is a 3.8% tax on certain investment income, such as dividends, interest, and capital gains.

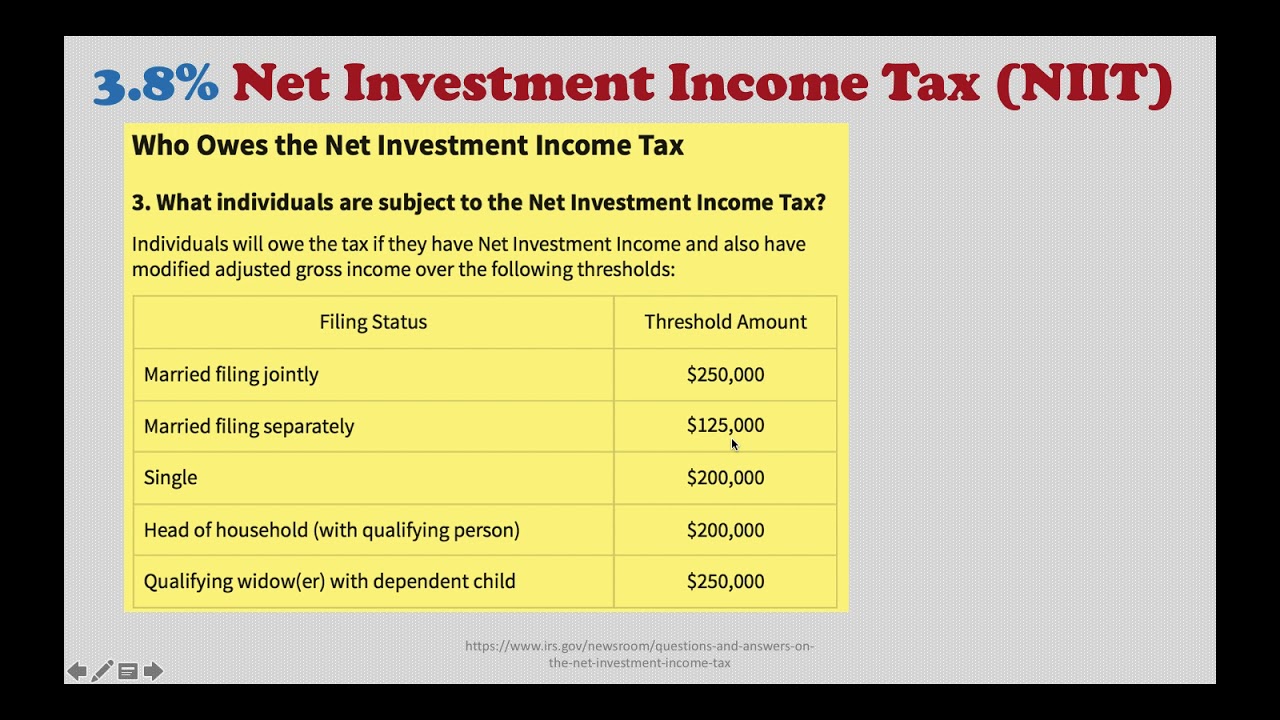

But you’ll only owe it if you have investment income and your modified adjusted. The net investment income tax (niit) is a 3.8% tax that kicks in if you have investment income and your income exceeds $200,000 for single filers, $250,000 for.

The net investment income tax (niit) is a 3.8% tax that kicks in if you have investment income and your income exceeds $200,000 for single filers, $250,000 for.

3.8 Net Investment Tax (NIIT) Overview YouTube, According to a june 2025 report by the congressional research service, because niit income thresholds are not indexed for inflation, more taxpayers become. Your nii or the excess of your modified adjusted gross income (magi) over these three thresholds:.

QBID + NIIT Management and… Buckingham Strategic Wealth, Your nii or the excess of your modified adjusted gross income (magi) over these three thresholds:. The net investment income tax (niit) is a 3.8% tax that applies to certain net investment income of individuals, estates, and trusts that have income above statutory threshold.

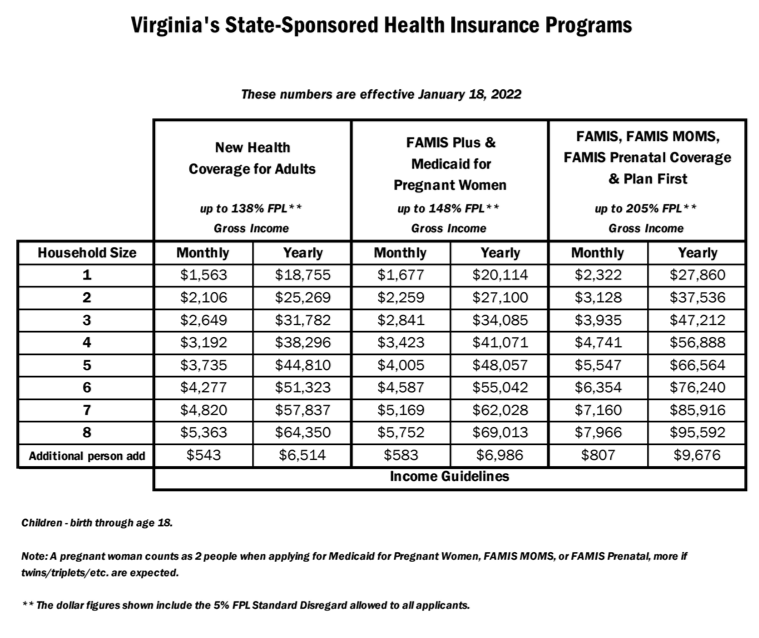

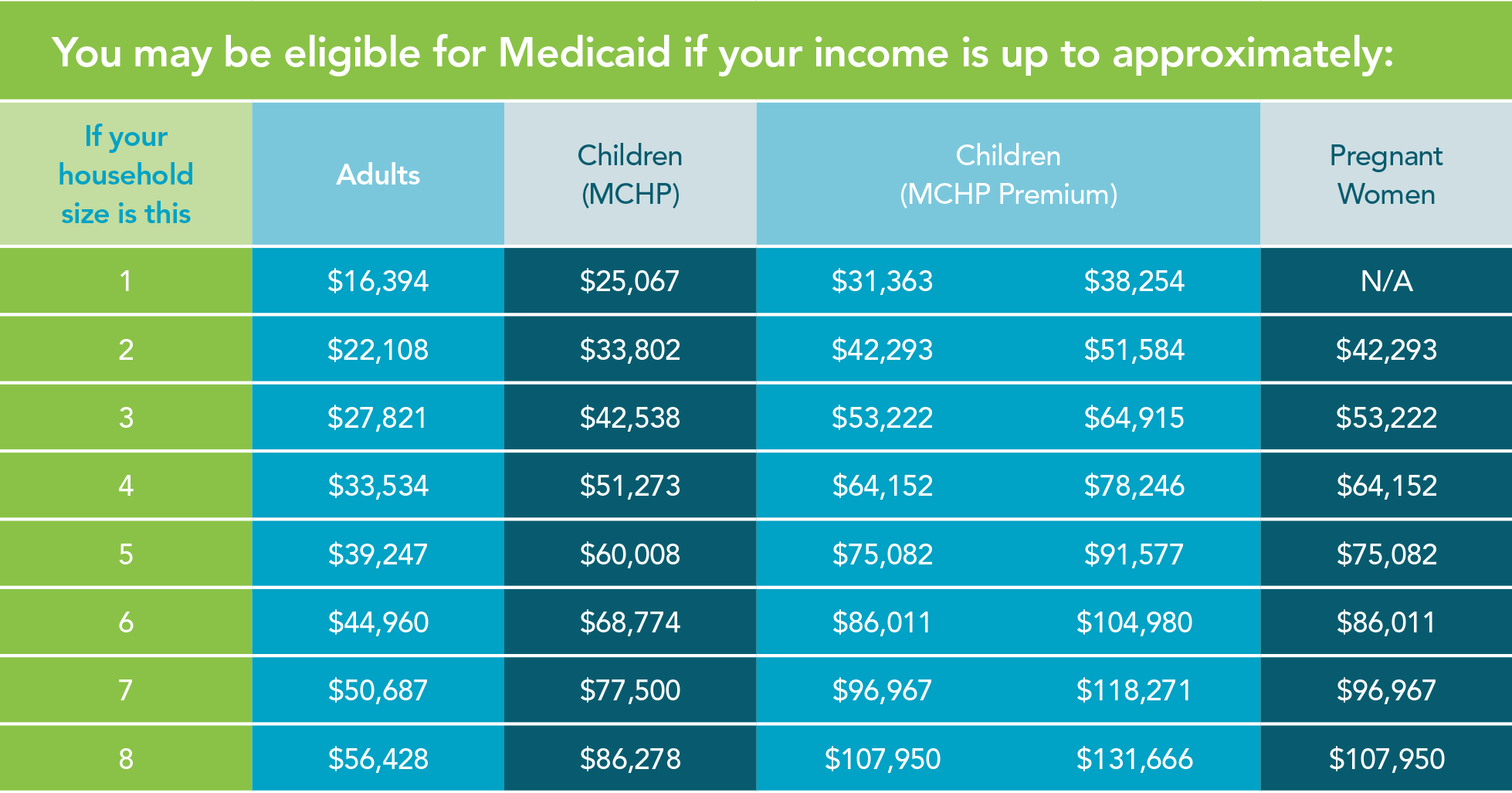

Limits For Medicaid 2025 Natka Vitoria, The niit would apply to. Your nii or the excess of your modified adjusted gross income (magi) over these three thresholds:.

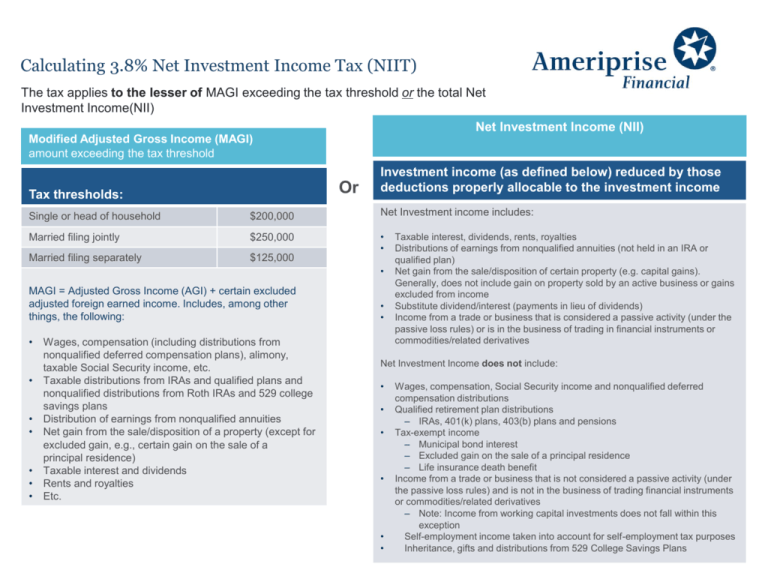

NET INVESTMENT TAX EXPLAINED Will I Have to Pay NIIT in, $120k (wages) + $40k (nii) =. Amount subject to the niit:

Or Calculating 3.8 Net Investment Tax (NIIT), The niit is a 3.8% tax on certain investment income, such as dividends, interest, and capital gains. Niit is a tax on net.

What Is The Limit For Ssi In 2025 Tasia Fredrika, What is the net investment income tax? Of how the company might have fared during the quarter ended february 2025.

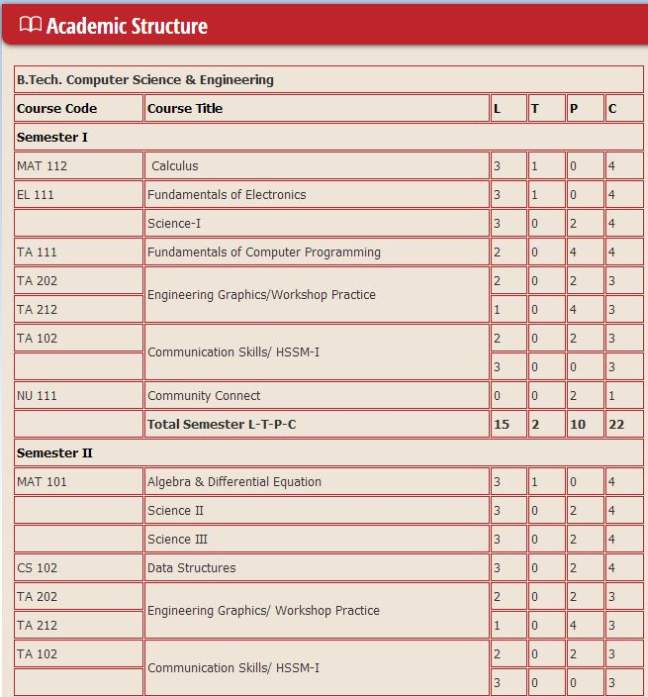

How Is NIIT University for B.Tech CSE 2025 2025 Student Forum, But you’ll only owe it if you have investment income and your modified adjusted. The niit is a 3.8% surtax imposed on income from various investment sources, such as interest, dividends, capital gains, rental income, and passive business.

Limits Medicaid 2025 Moina Terrijo, Your nii or the excess of your modified adjusted gross income (magi) over these three thresholds:. The niit is a 3.8% tax on certain investment income, such as dividends, interest, and capital gains.

T200252 Repeal Net Investment Tax (NIIT) Enacted by the, Niit is a tax on net investment income. The niit is a 3.8% surtax imposed on income from various investment sources, such as interest, dividends, capital gains, rental income, and passive business.

Special Net Investment Tax NIIT Rules for Dispositions of, The niit is a 3.8% tax. This income limit threshold is set by the internal revenue service and changes based on your tax filing status (married filing jointly, married filing separate, or single filing), but will.

The net investment income tax (niit) is a 3.8% tax that applies to certain net investment income of individuals, estates, and trusts that have income above statutory threshold.

Suppose you’re a single filer with a magi of $220,000, including $30,000 from net investment income.

Graduation Suits For Guys 2025. Cool graduation outfits for guys that will make you stand out at your graduation. Graduation…

Abc News Made In America December 12 2025. ‘world news tonight’ shares gift ideas that. During his address, the president…

Michigan Hockey Recruits 2025. Roster outlook for michigan state spartans. Beyond davis, the michigan wolverines are hosting a number of…